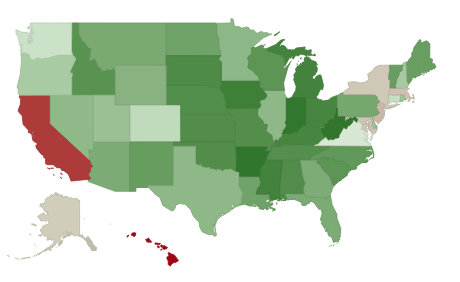

Subscribers can configure state/metro/county granularity,Īssorted fields and quantity of results. Zoom/scroll map to see bank's per metro statistics. To see how we can help with your market research, analytics or advertising needs. Mortgage professionals: We have various tools to make your lives easier. Mortgage seekers: Choose your metro area here to explore the lowest

Use advanced statistical techniques to forecast different rates based on a lender's historical data. This means that if a bank is a low fee/rate lender the past- chances are they are still one today.

Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. We show data for every lender and do not change our ratings- even if an organization is a paidĪdvertiser. (We use the term "fees" to include things like closing costs and other costs incurred byīorrowers- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

Indiana Members Credit Union is typically a low fee lender. They have a below average pick rate when compared to similar lenders. Indiana Members Credit Union has an average approval rate when compared to the average across all lenders. With an interest rate of 7, their monthly payment for mortgage and interest is going. Easily compare APRs, closing costs and monthly payments. average sales price was about 104 of the list price). (Some data included below & more in-depth data is available with Review free, personalized mortgage rates based on your specifc loan amount, program and other factors. (This may mean they shy away fromįirst time homebuyers.) Their top markets by origination volume include: Indianapolis, Evansville, Louisville, Muncie, and Bloomington among others. They have a a low proportion of FHA loans. Indiana Members Credit Union has a high proportion of conventional loans. For Crown Point, it is $282,300.Indiana Members Credit Union is a smaller credit union specializing in Home Purchase and Cash Out Refi loans. In terms of dollar values, the median home cost for the US as a whole is $291,700. Ruoff Mortgage’s headquarters are in Fort Wayne, so it’s familiar with the needs of Indiana residents. That means that it is only marginally more expensive to buy a home in Northwest IN than in most locations across the country. Best for FHA Loans in Indiana: Ruoff Mortgage. That housing costs in Crown Point receive a rating of just 102.1. What about he cost of housing? Once again, the US average on the scale is 100. Conventional mortgages have always required a 5 -20 down payment, which is fine for more seasoned home buyers, but out of reach for the average first-time. The cost of living in Crown Point is lower in almost every category than it is nationwide on average. It is also not a surprise that Northwest Indiana is a little more expensive, considering it is also more urban. Crown Point is a little more expensive than other parts of Indiana, but still quite cost-effective. So, the entire state is less expensive to live in than the average location in the USA. On that scale, the website gives Indiana a rating of 82.1, and Crown Point a rating of 98.2. Ratings above 100 are representations of higher than average costs of living, and ratings below 100 are representations of lower than average costs of living. Sperling’s Best Places rates cost of living on a scale where the US average is 100. But let’s take a look at what you could expect in Crown Point. Your exact cost of living in Northwest Indiana will depend on where you buy a home. What is the Cost of Living in Northwest Indiana?

0 kommentar(er)

0 kommentar(er)